how much tax do you pay for uber eats

The IRS imposes modest interest penalties if you dont pay enough estimated tax. If youre unsure how much you should be saving for tax or whether you need to register for GST or lodge BAS.

Can You Pay Cash For Uber Eats Yes But Not In The U S Here S How To Pay For Uber Eats In All Locations

In this article well take a closer look at how Uber Eats works how much it costs and how to place an order.

. Uber Eats drivers can expect to make around 8 12 per hour after factoring in vehicle expenses. Then you also pay income tax just like an employee but only on 80 of your profits if you make over 12k. Sole trader National Insurance rates are a bit different to those employees pay.

This includes 153 in self-employment taxes for Social Security and Medicare. It also includes your income tax rate depending on your tax bracket. Ad Keep Every Dollar You Deserve When You File Business Taxes w TurboTax Self-Employed.

This applies to earnings on both Uber rides and Uber Eats. Uber Eats delivery fees typically range from 099 to 599. Because then you would earn much less with uber eats than eg.

Meaning I only owed taxes on 100. Here are the due dates for 2021. Once youve input your information you can determine your take home pay and your tax burden broken down by week month quarter or year.

Here are HMRCs tax rates for the 201819 tax year. You have to deduct all your expenses you will owe tax on whatever the remaining amount net profit is I grossed 5200 between Uber and Lyft on 7500 miles net profit of 100 after mileage interest and cell phone deductions. In the 92nd year 3 out of 10 were below par.

All you need is the following information. Your salary for the year covered is 400 for a year over 600. To help you come out on top we ve put together five tips to help you pay less tax in 2018.

Does Uber Eats Report Your Income. Connect With A Self-Employment Tax Expert To Help You File Your Taxes Or Do Them For You. Make sure to pay estimated taxes on time.

Using our Uber driver tax calculator is easy. Yes you need to pay tax if you drive for Lyft Uber or similar companies like Uber Eats and other ride-share companies. You still only file your tax return once after the end of the year.

At that time you apply those estimated payments you made and either get. You must pay estimated taxes if you expect to owe at least 1000 in federal tax for the year from your ride-sharing business. Expect to pay at least a 25 tax rate.

If you want to get extra fancy you can use advanced filters which will allow you to input. Do you owe quarterly taxes. Youll have to pay.

Cause Ive seen it on the ATO website. Most Uber drivers in the UK are sole traders. Delivery pay can vary quite a bit from day to day and hour to hour and its crucial to work lunch and dinner rushes if you want to earn on the higher end of the pay scale.

Each quarter youre expected to pay taxes for that quarters payment period. Hi Jess I have read that People who work with the Visa subclass 417 Working Holiday Visa have to pay 15 taxes even if earn less than 18200 but the margin goes up to 34000 or something with the 15. Unlike rides with Uber drivers who earn with Uber Eats are only obligated to register collect and remit sales tax from the moment they reach 30000 of revenue over the past 4 quarters.

Since youre an independent contractor you might be responsible for estimated quarterly taxesespecially if Uber is your sole source of income. How much do Uber drivers pay In taxes. The main exception is that you dont have to pay income taxes if your total annual income is less than the standard deduction which is 12550 if youre a single-filer for 2021 taxes what you file in early 2022 and 25100 for married couples filing.

Your federal tax rate can vary from 10 to 37 while your state rate can be anywhere from 0 to 1075. You are required to pay 35 of your self-employment income. With Uber One membership that costs 999 a month you can get free delivery on eligible orders over 15.

You make estimated quarterly payments without needing any documents from Uber. There is a 15 percent self-employment tax for the 2021 tax year. It is possible to owe self-employment taxes if your ridesharing income exceeds 400.

How much do I pay in taxes as an Uber driver. Your federal and state income taxes. You are responsible to collect remit and file sales tax on all your ridesharing trips to the Canada Revenue Agency CRA.

So you pay 153 of this so called self employment tax. A 50-cent fee will apply if you dont have an Uber Visa Debit Card by GoBank. How Much Taxes Uber Drivers Pay.

Australians is that true. In addition Uber Eats charges a service fee of 15. Tax Deductions for Uber Eats and Other Delivery Drivers.

Sole traders pay tax at the same rates as regularly-employed people. In addition you should be able to download them in your Driver App under Account Tax Info Tax Forms tab. Youll probably need to earn a profit of at least 5000 or 6000 from your business to owe this much tax.

Whenever Uber pays you it will report how much you received in IRS Form 1099-MISC or in most state tax departments in W-2s and 1099s. From there you should be able to click Download next to your tax forms when they are available. The exact percentage youll pay depends on your state and your tax bracket which is usually based on how much you earned over the calendar year.

Note that if you dont cash out your earnings from the past week by Monday at 4am local time your earnings will be transferred into your bank account by the end of the week.

15 Must Know Uber Eats Tips Tricks 2022 Make More Money Driving

Uber Eats Launches Eat Local A Renewed Commitment To Us Local Merchants Business Wire

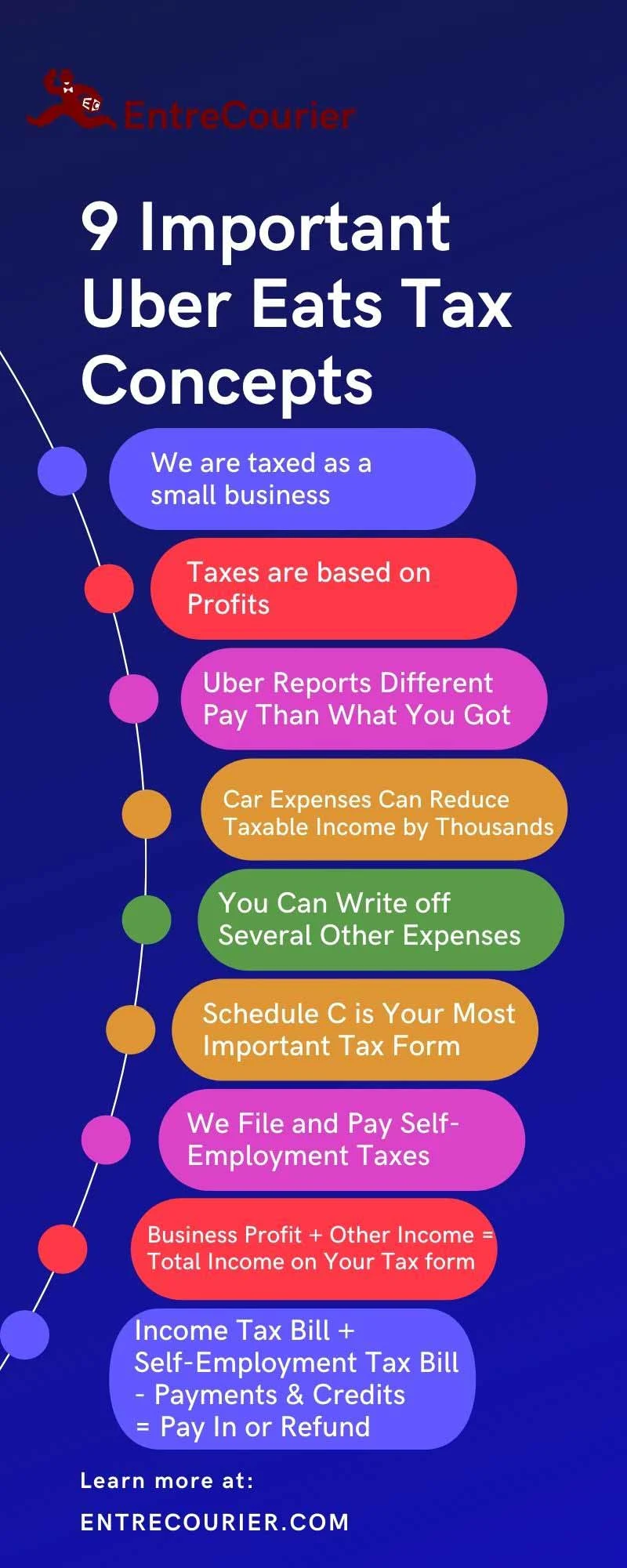

9 Concepts You Must Know To Understand Uber Eats Taxes Complete Guide

How To Become An Uber Eats Driver Thestreet

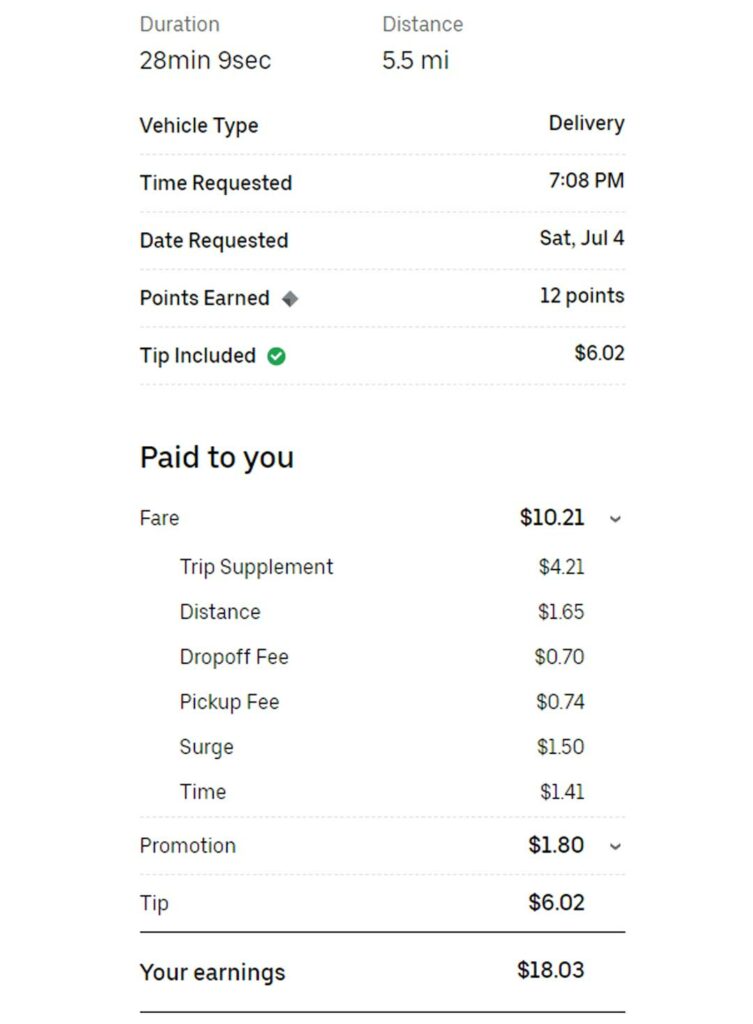

How Much Does Uber Eats Pay Know These 6 Strong Ways To Boost Pay

Uber Will Stop Its Restaurant Delivery In Brazil Protocol

How Much Do Uber Eats Bicycle Drivers Make 2022 Guide

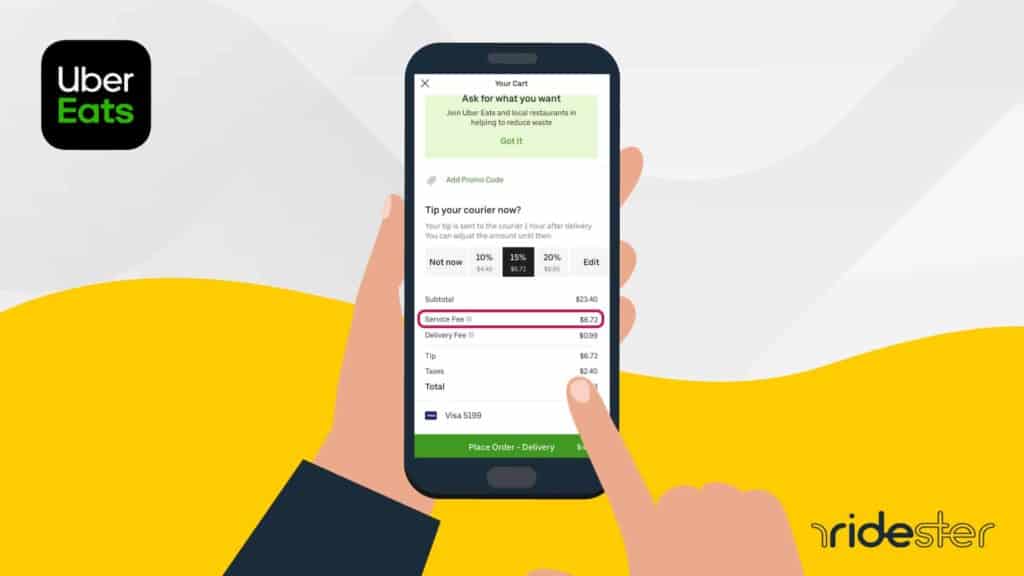

Uber Eats Service Fee Essential Information To Know Ridester Com

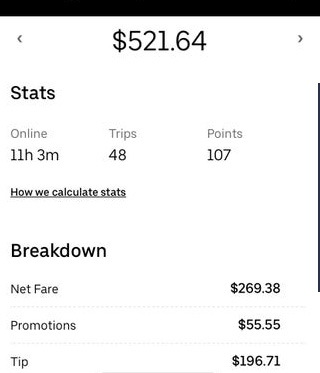

Whats The Most You Ve Made Doing Uber Eats Deliveries R Uber

How Much Do Uber Eats Bicycle Drivers Make 2022 Guide

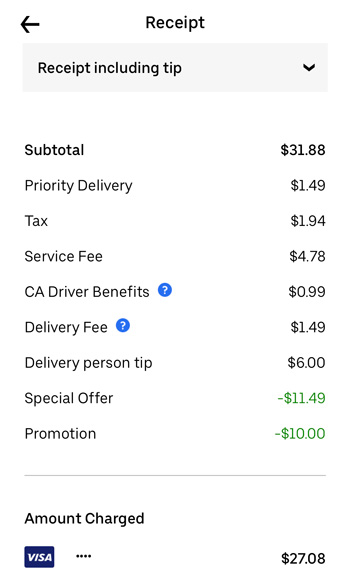

How Much Does Uber Eats Cost And Learn How To Save On Orders Ridesharing Driver

See The Range Of Uber Eats Driver Pay From 880 Week To 1 50 Orders Ridesharing Driver

/cdn.vox-cdn.com/uploads/chorus_asset/file/13300243/919042992.jpg.jpg)

Uber Eats Rolls Out Confusing New Fees Here S What They Mean The Verge

Why Does My Uber Eats 1099 Or Annual Tax Summary Say I Made More Than I Did Entrecourier

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/15972766/IMG_4316.jpg)

Uber Eats Rolls Out Confusing New Fees Here S What They Mean The Verge

See The Range Of Uber Eats Driver Pay From 880 Week To 1 50 Orders Ridesharing Driver

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/15972748/Screen_Shot_2019_03_19_at_1.52.15_PM.png)

Uber Eats Rolls Out Confusing New Fees Here S What They Mean The Verge

How Much Does Uber Eats Pay Know These 6 Strong Ways To Boost Pay