what taxes do i pay after retirement

But if your provisional income is greater than. Part is tax-free made up of.

Do You Have To Pay Taxes On Your Retirement Income It Depends Gobankingrates

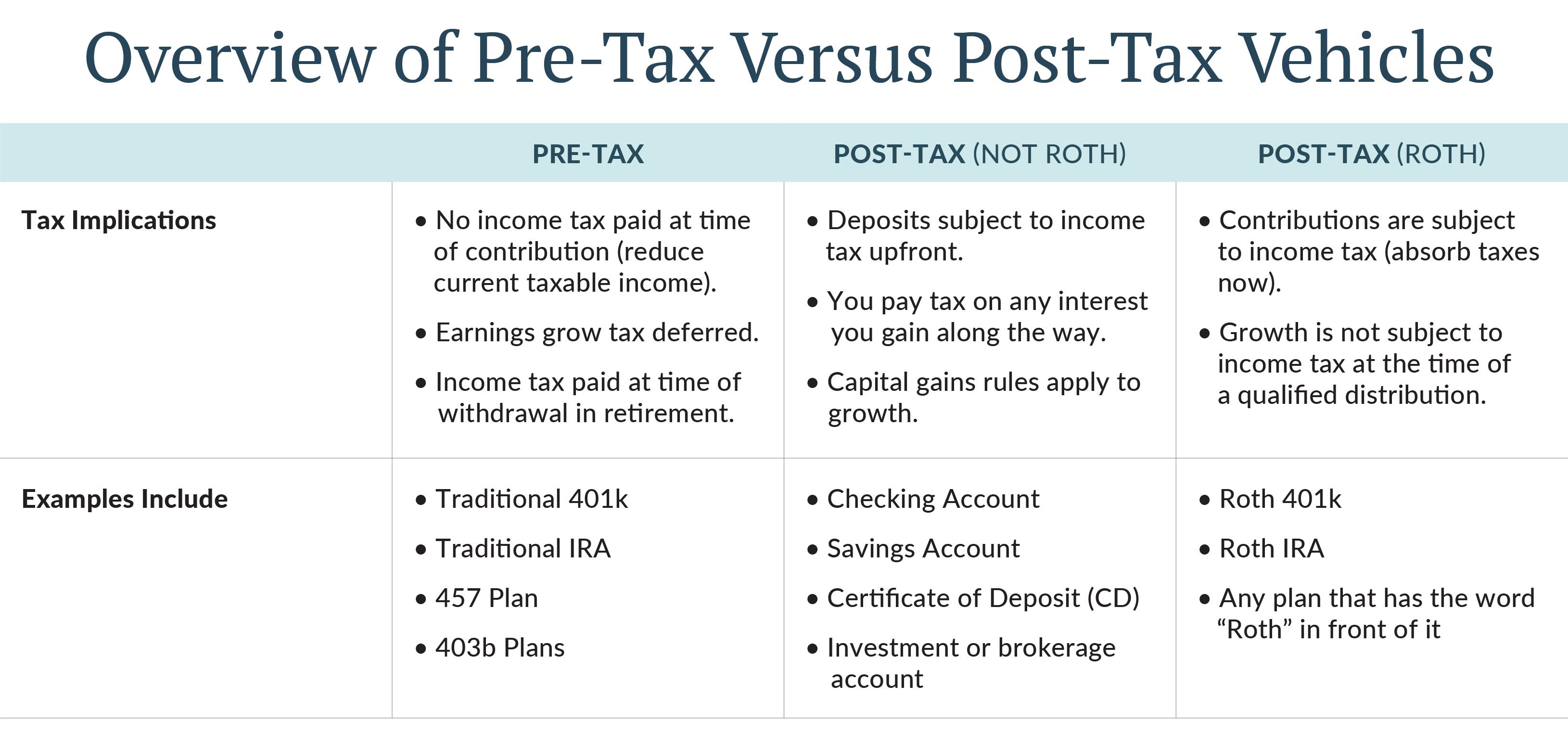

You can rollover over the funds into a new retirement plan without paying taxes.

. A single person making between 0 and 9325 the tax rate is 10 of taxable income. Although Roth 401k has a few advantages you still need to pay Social Security taxes. Common sources of retiree income are Social Security and.

Notably 85 of your Social Security is potentially taxable after retirement. Here are 24 tips for keeping more of your money. Everyone who earns income pays some of that income back into Medicare.

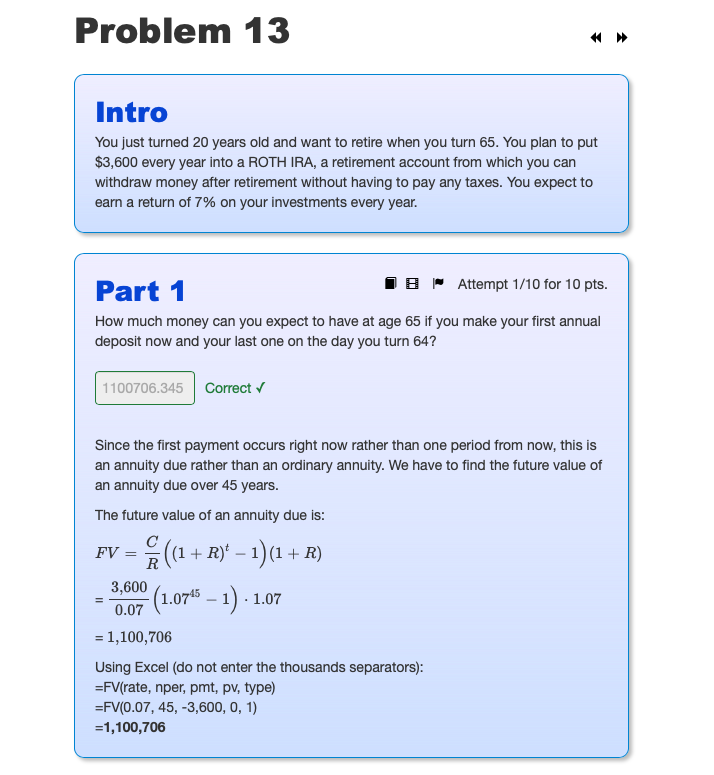

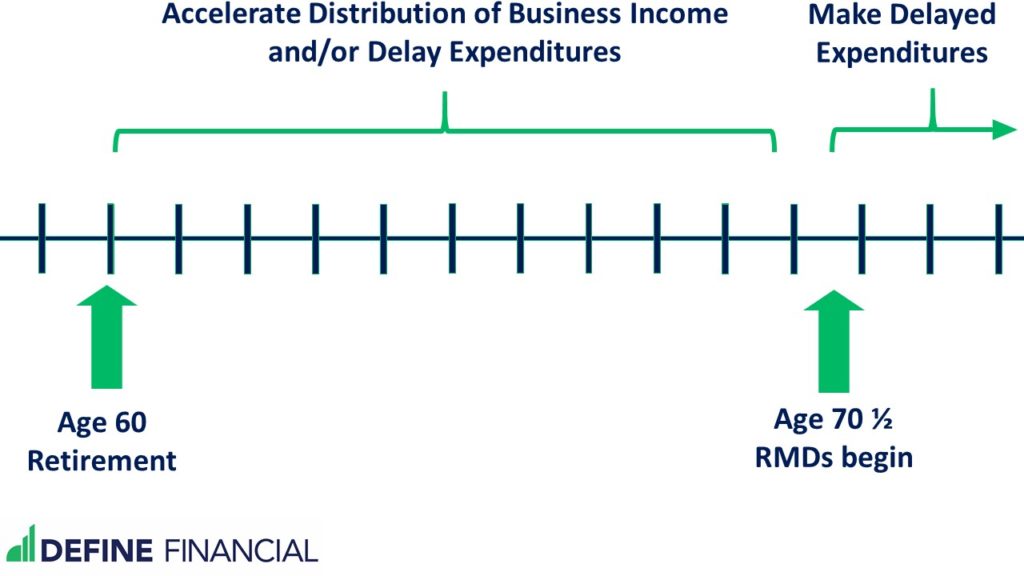

How much tax do I pay on 401k withdrawal after 60. Both your income from these retirement plans and your earned income are taxed as ordinary income at rates from 10 to 37. If youre age 60 or over.

Ada banyak pertanyaan tentang do i pay taxes on 401k after retirement beserta jawabannya di sini atau Kamu bisa mencari soalpertanyaan lain yang berkaitan dengan do i pay taxes on. FICA taxes are broken down as follows. For a single person making between 9325 and 37950 its 15.

Retirees who begin collecting Social Security at 62 instead of at the full retirement age 67 for those born in 1960 or later can expect their monthly. Income from the annuity. 5 And if you have an employer-funded pension plan.

The standard Medicare tax is 145 percent or 29 percent if youre self-employed. Anyone who withdraws from their 401K. If you file as an.

What your income is at the time will determine how much of your benefits are taxed. Most people age 70 are retired and therefore do not have any income to tax. You have to pay income tax on your pension and on withdrawals from any tax-deferred investmentssuch as traditional IRAs 401 ks 403 bs and similar retirement plans and tax.

If you have a traditional 401 k youll pay a 401 k distribution tax when you take the funds out at retirement. 25 of your pot before you buy an annuity. The good news is.

Yes Youll Still Pay Taxes After Retirement And It Might Be a Big Budget Item The average American pays about. Your entire benefit from a taxed super fund which most funds are is tax-free. Flexible retirement income pension drawdown 25 of your pot before you move the rest to get a flexible income.

Everyone working in covered employment or self-employment regardless of age or eligibility for benefits must pay Social Security taxes. This is 5440 over the limit. Do you have to pay taxes after 70.

Your Social Security check will be reduced by 2720 that year or 1 for every 2 earned. If you have a Roth 401k unlike the traditional 401k your contributions are made with after-tax money. 62 of wages for Social Security capped at 142800 of wages for 2021 and 145 of wages for Medicare no limit for a total FICA tax.

The short answer is yes. If you have 401 ks with former employers a rollover to a Roth IRA. In the year you reach your full retirement age you can.

If it falls between 25000 and 34000 or 32000 to 44000 for joint filers half of your Social Security benefits are taxable. Using the 2021 standard deduction would put your total estimated taxable income at 35250 60350 - 25100 placing you in the 12 tax bracket for your top dollars.

How Roth Ira Contributions Are Taxed H R Block

Step By Step How To Lower Taxes In Retirement

Research Income Taxes On Social Security Benefits

Tax Cut For Kansas Retirement Income And Social Security Proposed

Tax Implications Of Your Financial Planning Strategy Johnson Financial Group

How To Maximize Your Retirement And Benefits From The Military Moneygeek Com

Military Compensation Pay Retirement E7with20years

How Taxes Can Affect Your Social Security Benefits Vanguard

Will Your Planned Retirement Income Be Enough After Taxes Brady Martz Associates

Tax Tips For After Retirement Bankers Life Blog

Common Questions About Taxes After Retirement Thrivent

How Taxes Can Affect Your Social Security Benefits Vanguard

Seniors Can Make This Much Retirement Money Without Paying Taxes

Finding A Tax Friendly State For Retirement Accounting Today

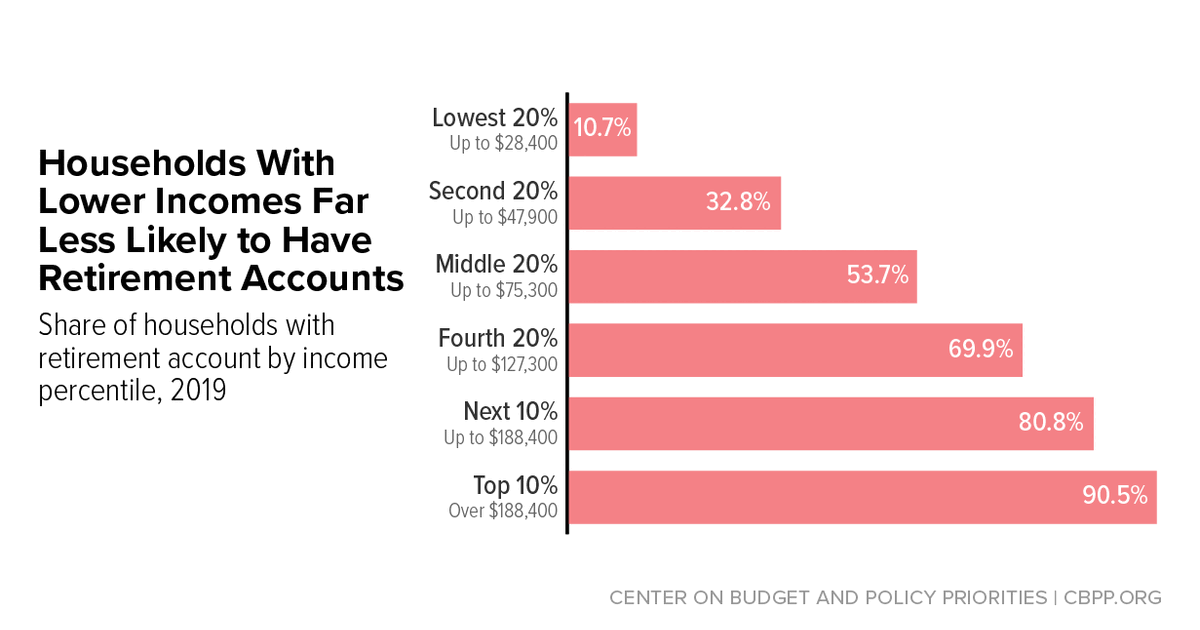

House Bill Would Further Skew Benefits Of Tax Favored Retirement Accounts Center On Budget And Policy Priorities

Research Income Taxes On Social Security Benefits

A Concise Guide To Taxes In Retirement Larsen Bruce Trimble Zachary M 9780998155418 Amazon Com Books